Decoding the $2 Billion Boy Math: A Message for the Ladies

Note: This article is for the ladies. If you're not one, kindly scroll on by.

Something extraordinary happened in recent weeks that most people missed. Not the part where Mira Murati raised $2 billion with no product – everyone saw that. The part where venture capital accidentally signed its own death certificate.

Let me explain.

The Numbers That Break Your Brain

Here's what we know:

Mira Murati (former OpenAI CTO) raised $2 billion at a $10 billion valuation

She has no product

She has no customers

She has a company called "Thinking Machines Lab"

This is the largest seed round in history

Meanwhile:

Women founders receive 2% of all venture capital

That's not a typo – two percent

Black women receive 0.27%

The percentage has been dropping, not rising

So let's do some boy math:

Money for nothing: $2,000,000,000

Money for all women with actual businesses: 2%

Now let's do the girl math:

Women-founded companies deliver 2x better returns than male-founded ones (BCG)

Women CEOs generate 20% more revenue with 50% less funding (Kauffman Foundation)

Women-led startups create 3x more jobs per dollar invested

Despite getting 2% of funding, women-founded companies generate 10% of revenues

One woman with no product gets what thousands of women with real businesses can't access.

And that's when I realized: VC firms are not gatekeeping – they're panicking.

The Mirror, The Confession, and The Cosmic Joke

Here's what VCs want you to believe: They're brilliant pattern-recognizers who identify innovation and fund the future. They take risks others won't. They see potential where others see problems. They're the brave enablers of human progress.

Here's what just happened: They gave $2 billion to their own reflection.

Mira Murati is the perfect mirror – Stanford-adjacent, OpenAI royalty, speaks their language, thinks their thoughts. She doesn't challenge the pattern; she IS the pattern. And they funded her with an amount that could transform entire industries just to avoid looking at anything else.

But let's decode what they're really funding. "Thinking Machines Lab" – notice the language?

Thinking: Masculine-coded, cerebral, disconnected from body wisdom

Machines: Synthetic, non-organic, controllable

Lab: Sterile environment, separated from natural creation

Mira is not bringing feminine wisdom to tech, she's bringing their exact worldview in a different package. Masculine logic in a female body, the safest possible 'diversity' bet. She's different enough to count but similar enough to feel safe.

The Moses Trap: When Good Intentions Meet Extraction Capital

Here's the heartbreaking part: Mira probably believes every word of her mission. "Empower humanity," "serve as an extension of individual agency," "distributed as widely and equitably as possible" – this is the language of someone who genuinely thinks she can use the master's tools to dismantle the master's house.

But her funders? They see her as Moses – useful for leading the exodus from OpenAI, destined never to enter the promised land herself. The $2 billion isn't funding her vision; it's buying:

The next OpenAI (10-100x returns required)

First-mover advantage in post-OpenAI AI

A "safe" revolutionary who won't actually revolutionise

A feminine face on the same extraction machine

We've seen this movie before. OpenAI's playbook in four acts:

Year 1: "We're building AGI for humanity!" (noble non-profit)

Year 2: "We need resources to compete" (for-profit subsidiary)

Year 3: "We must grow at all costs" (mission drift)

Year 4: "What mission?" (full extraction mode with AGI, hardware, government deals)

The physics of venture capital makes Mira's vision impossible. You cannot:

Take extraction capital and build regenerative systems

Serve venture returns and humanity equally

Build "equitably distributed" anything with concentrated ownership

Maintain "freedom" while owing $2B worth of returns

That $2 billion comes with board seats demanding 100x returns, quarterly growth pressure incompatible with "equitable distribution," liquidation preferences ensuring VCs get paid first, and the inevitable pivot from "empower humanity" to "maximize shareholder value."

The moment she took $2B from a16z (literally "beginning to end" control), she entered the synthetic womb. The term sheet is signed. The countdown to extraction has begun. When the growth demands conflict with the mission – and they will – she'll face the same choice every founder faces: your values or your company?

The tragedy? She could have built something beautiful with 1/1000th of that money through community funding. But $2B doesn't buy you freedom – it buys you the most expensive cage in history. The system doesn't fund revolutionaries. It funds revolutionaries it can eventually tame. And $2B is a very expensive leash.

The Synthetic Womb Problem

I've mentored over 500 startups through various accelerators and incubators. I've sat in countless pitch sessions, demo days, and board meetings. And I noticed something.

There's something darkly poetic about how venture capital works. The entire industry uses reproductive language – seed rounds, incubation, gestation periods, birth of companies. They literally copied the vocabulary of feminine creation. It's a synthetic womb - one big fertility ritual.

The goal of any investor is to seek fertile ground—a founder with the right genetics (credentials), energy (vision), and potential to scale (legacy). Sound familiar doesn't it?

The idea = the egg

The investor = the sperm

The pitch = the moment of fertilisation

The exit = the birth (IPO, acquisition etc)

But synthetic wombs can't actually create life. In the startup world you see founder after founder – especially women – contort themselves to fit the synthetic mould. Natural business cycles were rejected for hockey stick projections. Sustainable growth was mocked in favour of "blitz-scaling." Founders who wanted to nurture their companies were pushed to extract and exit.

The pattern was clear: They took the feminine blueprint of creation and inverted every principle. Where real wombs nurture, VCs extract. Where wombs follow natural timing, VCs demand impossible growth. Where wombs know when to release, VCs trap founders through liquidation preferences.

I've watched countless brilliant founders with revolutionary ideas get rejected for not "thinking big enough" while mediocre ideas that fit the pattern with derivative concepts got millions for "pattern matching." The synthetic womb only recognises its own reflection.

Not everything should be fertilised. Not every idea is ready to be born. But in the accelerator world, everything must be forced to term on a 3-month timeline, ready or not.

What they create are unicorns – mythical creatures that don't exist in nature. Companies force-fed capital until they bloat into billion-dollar "valuations" with no relationship to reality. WeWork. Theranos. FTX. I saw the smaller versions of these stories play out weekly – extraction dressed up as innovation.

But real wombs – actual creation – work differently. They operate on natural cycles. They nurture what's actually viable. They know when to release. They create life that contributes to the ecosystem.

After 500 startups, the pattern is undeniable: venture capital took the feminine blueprint, stripped it of its sacred wisdom, and created a machine that can only produce hollow births. They created a synthetic womb economy stripped of its sacred roots – and when capital no longer flows through the organic, we create systems that extract rather than nurture.

The Three-Headed Beast: Mirror Funding, Synthetic Wombs, and Scarcity Illusion

The venture capital system rests on three interconnected lies:

1. Mirror Funding

VCs aren't funding innovation. They're funding themselves. Every venture capitalist was once a founder (probably). Every founder they fund reminds them of themselves. It's a mirror reflecting a mirror reflecting a mirror, forever. They've created a closed loop that funds Stanford graduates to hire Stanford graduates to sell to Stanford graduates.

2. Synthetic Womb Economics

They stole the architecture of creation but inverted its values:

Where wombs nurture, VCs extract

Where wombs follow natural timing, VCs demand hockey stick growth

Where wombs release when ready, VCs trap through liquidation preferences

Where wombs create for life, VCs create for exits

3. The Scarcity Illusion

The $2 billion for nothing proves what we suspected: scarcity is performed, not real. There's infinite money for the right mirror. But maintaining the illusion of scarcity keeps founders desperate, compliant, willing to accept predatory terms.

These three patterns reinforce each other in a death spiral that's finally becoming visible.

The Corporate Body Without a Soul

Corporations are literally called bodies—the word 'corp' comes from the Latin corpus, meaning body. But unlike a living body, a corporation can live forever. It doesn't age, menstruate, or die. It is a synthetic womb, legally immortal.

This is what Mira Murati's "Thinking Machines Lab" represents – the ultimate synthetic womb. No messy humanity, no natural cycles, no sacred timing. Just machines thinking about machines, funded by machines, creating more machines. The perfect closed loop where nothing real can grow.

The Revolution They Can't Stop

Here's what the $2 billion headline buried: Women have already built the replacement economy.

While VCs were desperately funding empty synthetic wombs, women created:

Crowdfunding platforms that actually democratise access

Revenue-based financing that doesn't steal your company

Community funding circles based on trust not extraction

Angel groups that understand innovation comes from lived experience

Women are returning to closed-loop systems where ideas are birthed with care, scaled with integrity, and reinvested into the original soil that made them possible.

The revolution didn't announce itself with a TechCrunch headline. It built itself quietly, one excluded founder at a time, until suddenly there's an entire parallel economy that doesn't need Sand Hill Road's permission to exist.

They just paid $2 billion to avoid seeing what we built while they weren't looking.

Why This Moment Changes Everything

The $2 billion for nothing isn't just obscene – it's clarifying.

For decades, VCs maintained the fiction that scarcity was real. Not enough money to go around. Need to be selective. Only the best get funded. Market discipline. Fiduciary duty. All that jazz.

Then they wrote a $2 billion check for "Thinking Machines Lab" – a name that literally announces its disconnection from organic creation – and accidentally revealed the truth: There's infinite money for synthetic wombs that mirror their own sterility.

This is their "let them eat cake" moment. The mask-off, quiet-part-loud confession that it was never about innovation, never about merit, never about changing the world. It was about maintaining a specific world – theirs.

And that world? It's already over. They just wrote a $2 billion check to prove it.

What Women Are Building While They're Dying: The Real Revolution

While they're funding empty mirrors, here's what we're creating:

Creator Sovereignty: The Cindy Gallop Model

Cindy Gallop didn't just build MakeLoveNotPorn – she built it after being rejected by every VC for being "too controversial." Her response? Build it anyway. Fund it through the community. Create a platform that serves real human needs, not algorithmic extraction.

Her example is teaching women to own their creative output completely. No exits. No dilution. Just sustainable businesses that generate wealth while maintaining sovereignty. She's proven you can build a global platform without selling your soul to Silicon Valley

The Lesson: Stop asking permission. Build for the community that needs what you're creating. They'll fund you.

Regenerative Economics: The Rihanna Model

Rihanna turned her name into a portfolio. She incubated identity into intellectual property. She took the most sacred aspects of Black womanhood—visibility, sensuality, autonomy—and repackaged them into scalable capital assets.

But here's the key: Rihanna didn't exit. She didn't IPO. She created regenerative wealth that keeps flowing back to her and her community. Fenty Beauty didn't just capture market share – it changed the entire industry's consciousness about inclusivity.

The Lesson: Build businesses that regenerate rather than extract. Create wealth that flows, not exits.

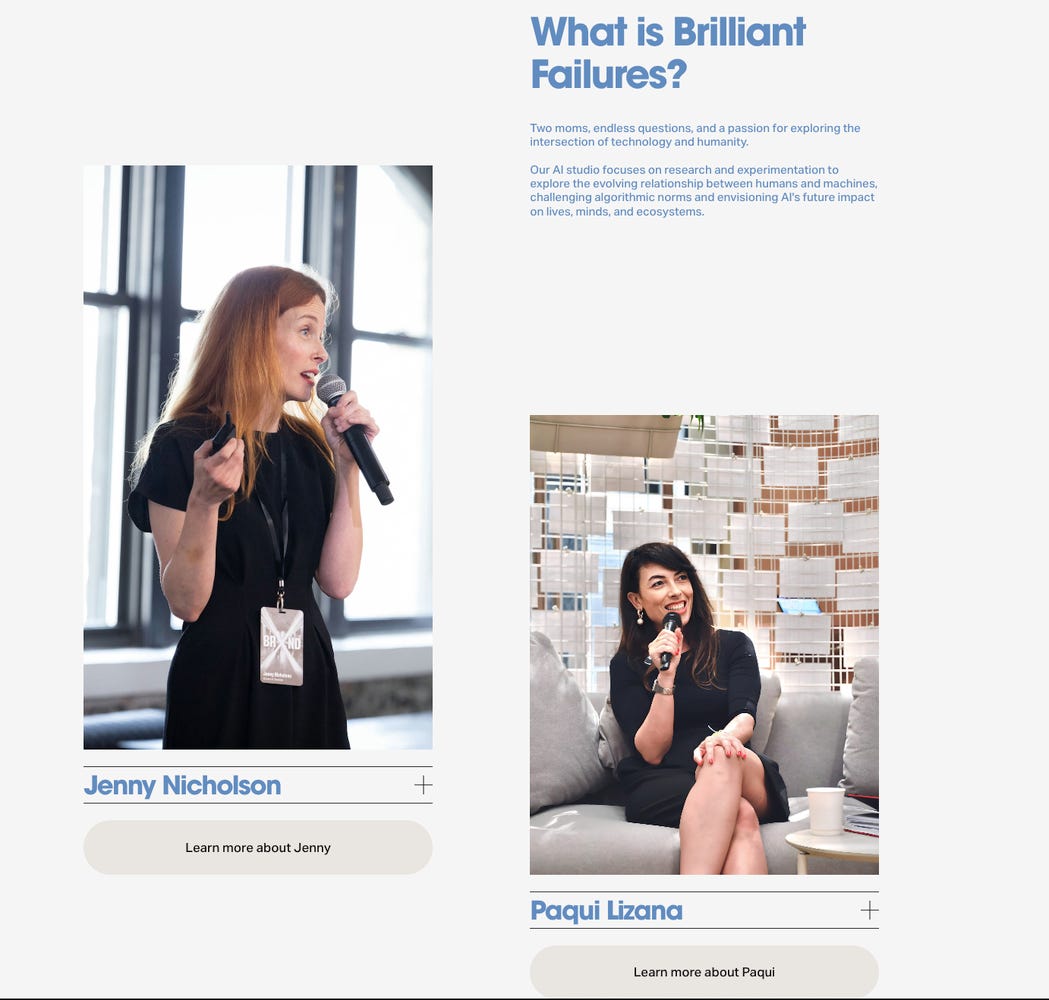

The Modern Renaissance Women: Jenny Nicholson & Paqui Lizana

At Brilliant Failures, Jenny Nicholson and Paqui Lizana⚡ MBA, MTH are revolutionising how we think about "failure" itself. Their AI Working Mothers cohort program isn't just teaching tech skills – it's creating a sisterhood of women who understand that every "no" from VC is actually data about what the system can't see.

They're teaching women to build AI-powered businesses that serve real human needs, not VC pattern matching. More importantly, they're reframing failure as iteration, learning, and evolution – the actual components of innovation.

Like Renaissance women in the past who created salons when universities barred them, Brilliant Failures and their cohort are the modern Medicis - not seeking patronage but becoming the patrons, creating parallel institutions where 'failure' is just data about what the old world can't see.

The Lesson: Your "failures" are their blind spots. Build there.

Community at Scale: Female Founders Rise

With 10,000 female and non-binary founders, Female Founders Rise founded by serial exited entrepreneur Emmie Faust isn't asking for a seat at the table – they built their own damn building. This isn't a networking group; it's an economic force. When 10,000 founders share resources, knowledge, and capital, they don't need VC permission to scale.

They're proving that community IS the new capital. Shared resources, collective wisdom, mutual support – these aren't soft skills, they're hard economics.

The Lesson: Scale horizontally through community, not vertically through extraction.

Knowledge Liberation: Sabrina Ramonov's AI Revolution

Having succeeded in tech, Sabrina Ramonov 🍄 could have started another fund. Instead, she created a AI education channel and Women Building AI Discord channel where AI education is completely free. She's democratizing access to the tools that will define the next economy.

This is womb economics in action – having received, she gives. Having learned, she teaches. The abundance multiplies through circulation, not hoarding.

The Lesson: When you succeed, pull others up. Knowledge shared is power multiplied.

Economic Activism: Buy Women Built

BuyWomenBuilt.com isn't just a directory – it's economic direct action. Every dollar spent on women-owned businesses is a dollar that doesn't need VC intermediation. It's building an entirely parallel economy where women support women directly.

They're making visible what VC keeps hidden: women are already building everything we need. We just need to fund each other.

The Lesson: Your purchasing power is political power. Use it intentionally.

Community Funding: The Alexis Ohanian Evolution

When Alexis Ohanian Sr. left Reddit, he didn't start another traditional VC fund. He specifically committed to funding women's sports and underrepresented founders. His 776 fund isn't trying to find the next unicorn – it's trying to fund the future that includes everyone.

But more importantly, he's modelling what men with resources should do: step back, fund women, and stop pretending the mirror system works.

The Lesson: Allies with capital exist. Find them. And if you man still reading this when you have capital, become one.

Women-Led Funds: The New Guard

Arlan Hamilton's Backstage Capital: Started while homeless, now managing millions specifically for underrepresented founders

All Raise: Creating systemic change by getting more women into VC roles

Female Founders Fund: Proving that funding women delivers returns

BBG Ventures: Built by women, for women, creating different metrics for success

And many more! These aren't reformed VC funds – they're completely different organisms operating on different principles.

Mutual Aid Tech: Ancient Wisdom, Modern Tools

Platforms like:

Kiva: Microloans creating global sisterhood funding

iFundWomen: Crowdfunding specifically for women entrepreneurs

The Helm: Investment platform democratizing access

Zebras Unite: Creating cooperative, sustainable business models

These tools encode mutual aid principles into technology, creating abundance through circulation rather than extraction.

Narcissus Exposed: Breaking the Mirror

The most powerful tool we have? Simply naming what we see. Every woman who publishes her rejection stories, every founder who shares the predatory terms they were offered, every article that shows the pattern – we're collectively breaking the mirror.

Your Practical Liberation Toolkit

Here's exactly what to do:

1. Stop Seeking Their Validation

Their "no" means nothing about your idea's value

Their "yes" often means selling your soul

Build anyway

2. Find Your Funding Sisters

Join communities like Female Founders Rise, Zebras Unite, iFundWomen

Look for revenue-based financing options

Consider community rounds and crowdfunding

Connect with women-led angel groups

3. Build Regeneratively

Design for sustainability, not exit

Create businesses that nurture, not extract

Honour natural cycles in your growth

Measure success by impact, not valuation

4. Document Everything

Share your journey publicly

Name the predatory practices you encounter

Celebrate alternative funding wins

Help other women see the path

5. Fund Each Other

When you have resources, fund women

Create informal funding circles

Share opportunities, not competition

Build the ecosystem we need

6. Listen to the Market, Build What it Needs

Instead of building from VC pattern matching, build from actual human need:

Your "too niche" idea probably solves a real wound

That "not scalable enough" solution might be exactly what a community needs

The "not big enough market" is often a market in deep pain

Listen to what people actually need, not what VCs think they should want

Build businesses that heal wounds rather than create them

Let the market tell you what it needs rather than forcing solutions onto it

This is your superpower: You can hear what the synthetic wombs can't. Every rejection for being "too small" or "too specific" was probably validation that you were onto something real – a genuine need that mirrors can't reflect.

Build from the market wound, create the medicine.

The best businesses are midwives to what the market is already trying to birth.

(Soft plug: You can learn how to do this here)

The Return to Source

The female body was the first algorithm. She calculates risk, stores patterns, and creates life from vibration alone. A thought. A feeling. A frequency.

This is what venture capital can never replicate with its thinking machines and synthetic wombs. Real creation requires:

Embodied wisdom, not just cerebral processing

Natural cycles, not forced timelines

Community nurturing, not individual extraction

Sacred timing, not market timing

The invitation is simple: Remember that we are the innovation. We are the original offering. We are the fund. We are the return.

P.S. - To every woman founder reading this: The system that just gave $2 billion to nothing while denying most women $50K for something real has shown you exactly what it is: scared and dying. Stop trying to get into their game. We already building a better one. Find us. We're everywhere, funding each other, creating the future. The revolution doesn't have a pitch deck. It has a pulse.

P.P.S. - Start here: Pick one woman-owned business and fund it today. $10, $100, $1000 – whatever you can. Buy from Buy Women Built, Join Sabrina's Discord. Apply to Female Founders Rise. Show up to a Brilliant Failures event. Learn to your market whispers and build what it truly you to sell.

The future is a practice, not a promise. Practice it today.